Heloc qualifying calculator

If you used your HELOC for qualifying expenses to buy build or substantially improve your home these deductions are worth taking so save your receipts and records. A good mortgage broker is normally able to put you into a program at a competitive rate.

Heloc Qualification Calculator Free Home Equity Loan Calculator

Banks like the Bank of Nova Scotia are national and can also provide immediate financing for your loans.

. Depending on the way you intend to use the borrowed funds one or the other may be considerably more affordable in terms of interest charges. It can also display one additional line based on any value you wish to enter. The big change for second mortgages is what debt is considered qualifying.

Heres a look at what they will consider before qualifying you for a mortgage. For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. Qualifying DTI ratios will vary from lender to lender.

A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards. The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes. In this scenario you might be able to get a home equity line of credit of up to 50000.

Explore personal finance topics including credit cards investments identity. Now the tax code. Differences and Similarities Between a Home Equity Loan and a HELOC.

So if a single filer were to take out a 75000 HELOC and use it to build an addition onto his home he could deduct the home equity loan interest paid on the entire 75000. Download the Lower App. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100.

Rates terms and qualifying details not applicable to stand-alone HELOC options. Much like a credit card a HELOC is a revolving credit line that you pay down and you only pay interest on the portion of the line you use. They offer HELOCs starting at a 199 APR for the first 12 months and then a 45 to 84 rate thereafter.

The EIC reduces the amount of taxes owed and may also give a refund. Use Bankrates loan prequalification calculator to determine your ability to qualify for a home or auto loan. A HELOC combination product or HELOC Combo is a combination.

To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance. To qualify for a customer relationship discount you must have a qualifying Wells Fargo consumer checking account and make automatic payments from a Wells Fargo deposit account. In practice however most buyers end up pre-qualifying with a bank or a realty institution through their real estate agent or mortgage broker.

15000 to 750000 up to 1 million for properties in California. Top Reasons Not to Use a HELOC. A set base rate called a margin plus a fluctuating rate called an index The index for HELOCs is the Prime Rate which is a rate that changes as the Fed adjusts rates throughout each year.

Some require that your monthly debts eat up less than 36 percent of your gross monthly income while other lenders may be willing to go as. Qualifying to Refinance. Sallie Mae reserves the right to close a dormant account which the bank defines as an account with 100 or less in it that doesnt have qualifying activity for the past 12 months.

But if he were to use it to buy a boat or pay for his daughters college expenses he could only deduct the interest paid on the first 50000 of the amount. They want you to succeed and make those monthly payments that make the world or at least the US. If automatic payments are canceled for any reason at.

You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status. 3 Get a New Home Equity Loan. To qualify for a HELOC refinance you need to have adequate home equity to meet the lenders guidelines.

Lower App Refi Calculator HELOC Calculator VA Calculator Secure Upload. Available Credit Withdraw funds Make a payment. Rates are adjustableHELOCs are adjustable-rate loans and HELOC rates are based on two components.

With a Bank of America HELOC there are no closing costs no application fees no annual fees and no fees to use the funds. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. Generally speaking it is easier to qualify for a HELOC when you have a large amount of home equity and a low loan-to-value ratio.

So when you apply for a loan the lender will scrutinize your financial situation to make sure you are worth the risk. You will also need a good credit history credit score of 620 or higher and a debt-to-income DTI ratio in the low 40s or lower. Fifth Third Bank does not charge closing costs a potential cost-savings advantage.

250000 X 80 200000. Prior to the 2017 TCJA virtually all second mortgages qualified. Thats because the amount of the HELOC plus the amount you owe on your mortgage can be no higher than 200000.

A HELOC often has a lower interest rate than some other common types of loans and the interest may be tax deductible. The main difference between a home equity line of credit and a HELOC concerns the way you receive and repay what you borrow. With a Bank of America HELOC there are no closing costs no application fees no annual fees and no fees to use the funds.

Your home is worth 250000 and you currently owe 180000. Available Credit Withdraw funds Make a payment. To qualify for a HELOC youll need to have more than 15 20 equity in your home at its current appraisal value.

2 Open a new HELOC. Connect Facebook Instagram LinkedIn Glassdoor Zillow. Going off our earlier example lets say you find a lender whos willing to give you a HELOC with 80 LTV.

To learn which accounts qualify for the discount please consult with a Wells Fargo banker or consult our FAQs. Much like a credit card a HELOC is a revolving credit line that you pay down and you only pay interest on the portion of the line you use. For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three.

Puegzfpkmt19hm

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Calculator Forbes Advisor

Puegzfpkmt19hm

Can You Use Home Equity To Invest Lendingtree

Heloc Calculator Forbes Advisor

Home Equity Line Of Credit Heloc Rocket Mortgage

What Is Heloc Heloc Loans Home Improvement Loans Heloc Home Equity

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Calculator Forbes Advisor

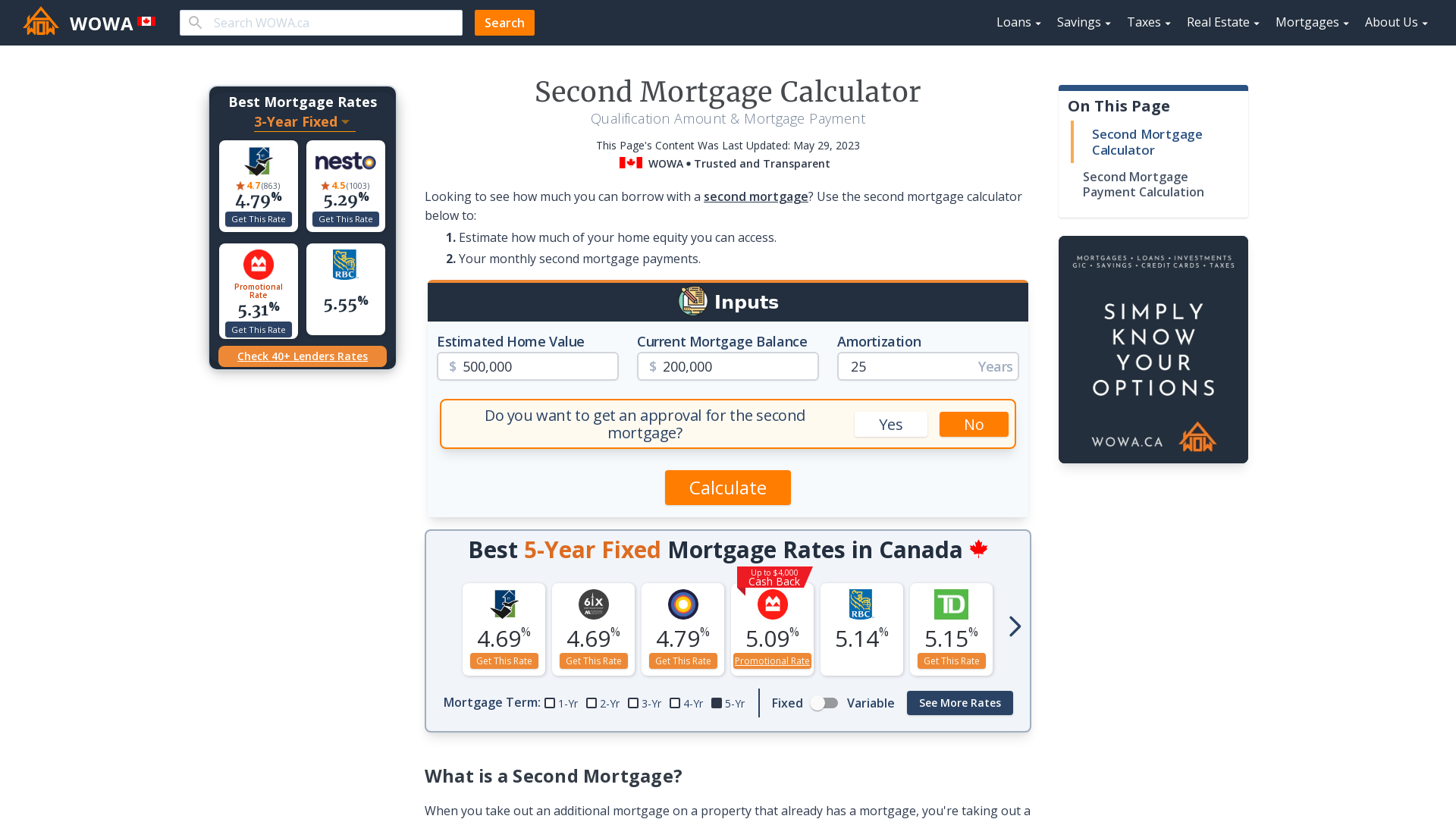

Second Mortgage Calculator Qualification Payment Wowa Ca

Home Equity Line Of Credit Heloc Rocket Mortgage

Research How To Refinance A Mortgage American Financing

Home Equity Line Of Credit Heloc Rocket Mortgage

Requirements For A Home Equity Loan And Heloc

Mortgage Calculator How Much House Can You Afford Finder Com